Tel: 0161 652 3443 | Email: sales@aeronacca.co.uk

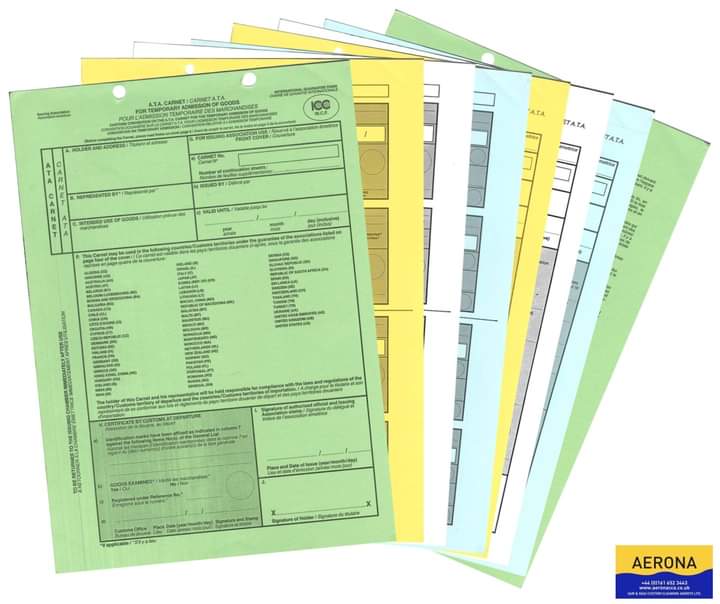

ATA Carnet

The best way to take goods temporarily out of the UK

At the moment, excluding EU countries, you may need permission to temporarily move goods out of the UK to another country and that is where an ATA Carnet comes in because it acts just like a temporary passport for the goods.

If the goods you wish to move are accompanied by an ATA Carnet document you can present this at each customs post and it enables the temporary exportation without the need for you to lodge duties on deposit with overseas’ customs.

Countries that currently accept an ATA Carnet include:

Albania, Algeria, Andorra, Australia (including Tasmania), Bahrain, Belarus, Bosnia and Herzegovina, Brazil, Canada, Canary Islands (Spain), China, Chile, Faroe Islands, French overseas departments and territories (Guadeloupe, Martinique, Guyana and Reunion, New Caledonia and its dependents of Wallis and Futuna Islands, and French Polynesia including Tahiti, as well as St Barthelemy, St Martin, Mayotte and Saint Pierre et Miquelon), Gibraltar, Hong Kong, Iceland, India, Indonesia, Iran, Israel, Ivory Coast, Japan, Kazakhstan, Korea, Republic of, Lebanon, Macao, Macedonia (Former Yugoslav Republic of), Madagascar, Malaysia (territory also includes Kuala Lumpur, Sabah and Sarawak), Mauritius, Mexico, Moldova, Mongolia, Montenegro, Morocco, New Zealand, Norway, Pakistan, Qatar, Russian Federation, Senegal, Serbia, Singapore, South Africa (territory also includes Botswana, Namibia, Swaziland and Lesotho), Spanish overseas territories of Ceuta and Melilla, Sri Lanka, Switzerland (territory includes Liechtenstein), Taiwan (not covered by ATA Carnet; a separate Carnet is available from London Chamber), Thailand, Tunisia, Turkey, Ukraine, United Arab Emirates, USA (territory includes Alaska, Hawaii, Puerto Rico and Saipan).

It is worth noting though that not every country has signed up to the ATA Carnet agreement. Speak to us in order to obtain the latest information.

This international agreement is especially beneficial if you are:

1. Attending international trade fairs and exhibitions.

2. Carrying commercial samples to different countries.

3. Transporting professional equipment abroad.

The application process

An ATA Carnet application can be made manually by requesting a form from the Chamber of Commerce or it can be processed electronically.

The cost

The current issuing fee depends on your status:

• Chamber members (24hr service) £206.40

• Chamber members (Express 2hr service) £412.80

• Non-members (24hr service) £344.40

• Non-members (Express 2hr service) £550.80

The necessary security

In all cases Carnet holders are required to provide a security that relates to the value of the goods being temporarily exported. This security is determined by the ATA Carnet Security Rate Chart and must be provided in one of the following ways:

• A banker’s draft or cash

• A Bank Guarantee. Banks that we can currently accept guarantees from are: Bank of Scotland plc, Barclays Bank plc,

HSBC Bank plc, Lloyds Bank plc, TSB Bank plc, Santander UK plc, Standard Chartered Bank, The Royal Bank of Scotland plc.

• A Carnet Security Scheme (CSS) Guarantee. This is an in-house service allowing the Carnet user to arrange for the security to be

provided without having to supply either Banker’s Draft, cash or Bank Guarantee. Using CSS, which is a non-refundable, one off

payment, means Aerona can provide you with a ‘While You Wait’ processing service and there is no ‘freezing’ of assets or funds.

What can an ATA Carnet be used for?

• Commercial samples.

• Goods for presentation or use at trade fairs, shows, exhibitions or similar events.

• Professional equipment (which is solely for use by, or under the personal supervision of the holder or his nominated

representative).

The Carnet can be used for a trip covering more than one country and includes numerous exits and re-entries in the country of origin during the period of the validity of the document. This validity can never exceed one year. Temporary admission under cover of ATA carnets applies to goods, which will be re-exported in the same state in which they were imported.

A Carnet may not be used for:

• Goods to be sold or hired out abroad for financial gain.

• Perishable or consumable items (as they would not normally be re-exported).

• Goods that are temporarily exported for processing or repair.

• Goods on which a CAP (Common Agricultural Policy) refund will be claimed.

• Goods used as a means of transport.

• The exportation of unaccompanied goods, or by post.

• Foreign goods temporarily imported into the E.C. under a Customs Temporary Importation Concession.

• Equipment to be used for the construction, repair or maintenance of buildings or for earthmoving and like projects.

In order to acquire an ATA Carnet you will have to declare the intended use of the goods, your itinerary, plus a clear description of the goods that will be temporarily exported.This needs to include serial number, weight and value in order to prevent fraud or substitution.

Remember though, each ATA Carnet is valid for no more than one year from the date of issue.

Your best bet is to contact us for an informal chat on how we can assist you and apply for the ATA Carnet on your behalf in order to take all the hassle, complications and complexities off your shoulders so that you can make your travel arrangements with confidence and peace of mind.

Please note:This information relates to prevailing conditions, rules and regulations.The conclusion of Brexit negotiations may or may not result in some changes. We will continue to monitor the situation closely.